single life annuity vs lump sum

Not surprisingly the monthly payout will be higher with a single-life annuity than if you opt for the joint-and-survivor benefit because the expected payment period is longer. Lump Sum vs.

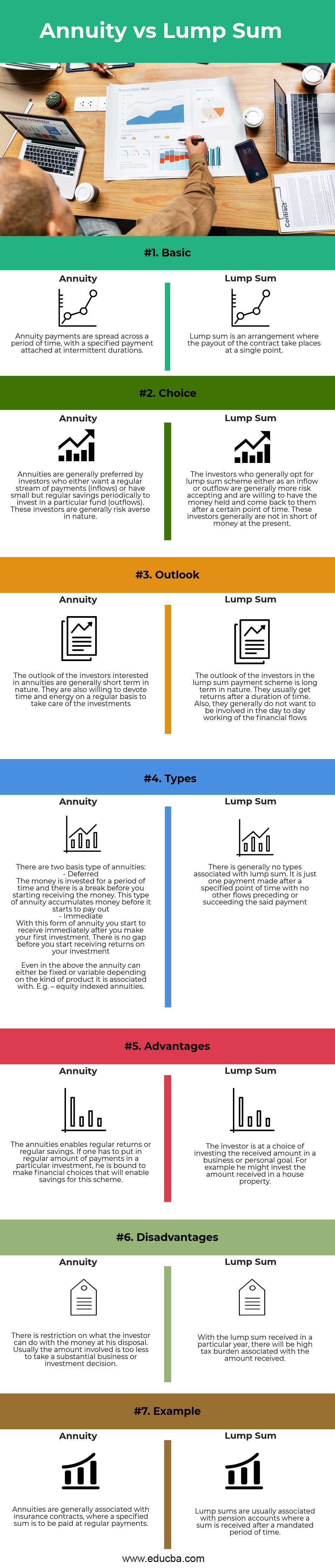

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Lets see the top.

. Use the Lump Sum vs. Life annuity with 10 years certain. A portion of your vested balance in a single lump sum distribution with the remaining balance distributed in one of the other permitted forms.

Get your exclusive free annuity report. Both options offer retirees. People trying to decide between a lump sum or an annuity often focus on whether they could earn more by investing the lump sum Russell says.

An annuity payment often consists of multiple payments over time such as on monthly quarterly or annual schedules. Ad Annuities provide guaranteed returns with no market risk. Ad Learn More about How Annuities Work from Fidelity.

A real-life example could be fixed deposits in banks that pay the investor a lump-sum amount at the end of the maturity period. Many people with a retirement plan are asked to choose between receiving lifetime income also called an annuity and a lump-sum payment to pay for their day-to-day life after. Private Wealth Management 04302019.

Monthly Pension Benefit Payable at normal retirement date single life annuity 74874. But at retirement people should. 50 joint and survivor annuity.

A lump sum involves receiving a large cash payout once you retire while a life annuity allows you to receive regular payments for the remainder of your life. The former provides an immediate up-front amount say 300000 but the pension. A lump sum allows you to collect.

Lump sum Weigh the options between lump sum and annuity payments. Annuities are often complex retirement investment products. Single life annuity.

SPIAs are commodities that need to be. This is a good check on our math as both the Annuity and Lump Sum tend to be. Learn some startling facts.

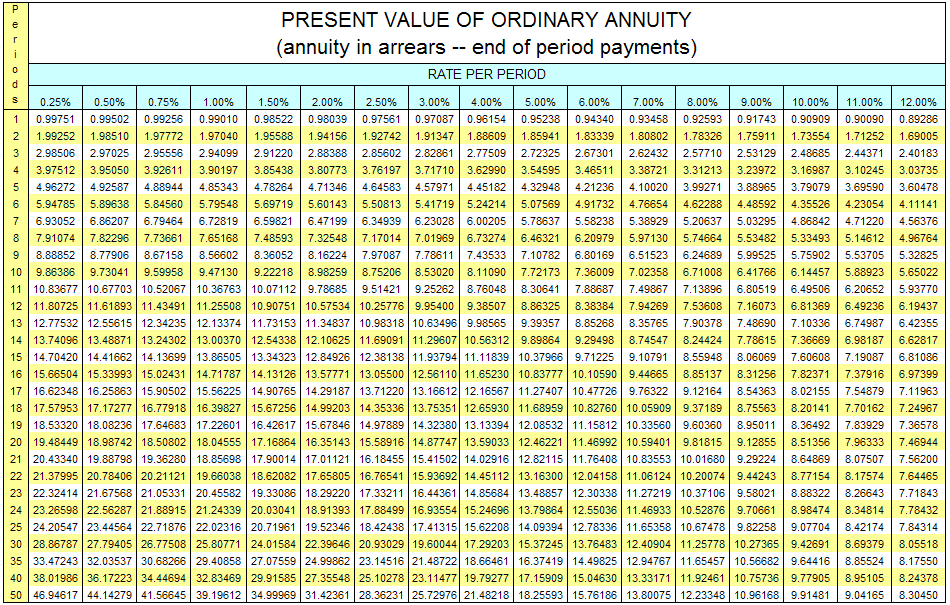

Annuity Calculator from North American Savings Bank to help determine whether its better to get a lump sum or receive an annuity. PV of Benefit 29806 this is the Lump Sum Amount you would receive today. Buy What You Need Not What Someone is Sellin Stan Haithcock The Annuity Man April 29 2020 There are over 10000 baby boomers.

A Single Premium Immediate Annuity SPIA is a fixed annuity that is issued by a life insurance company and regulated at the state level. Ad Learn More about How Annuities Work from Fidelity. Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

External Links Disclaimer If you. Pension Annuity vs. Is a lump sum offer from an employer a better choice than a pension annuity for life.

Single life with term certain. The Lump Sum 138000 if compounded at 5 for 17 years would grow into 316000. The end result shows that the present value of the monthly pension is greater than the lump sum using the inputs selected.

If the annuity is fixed ie. Pays you the same exactly amount every month for the rest of your life you can simply compare the payout of the annuity with the payout you could. A lump sum distribution payable to you.

100 joint and survivor annuity.

Difference Between Annuity And Lump Sum Payment Infographics

What You Need To Know About A Lump Sum Life Insurance Payout Sproutt

Strategies To Maximize Pension Vs Lump Sum Decisions

Should You Take The Annuity Or The Lump Sum If You Win The Lottery

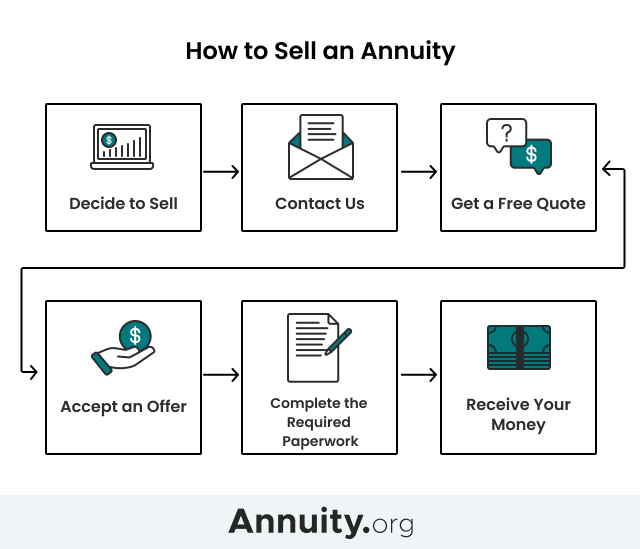

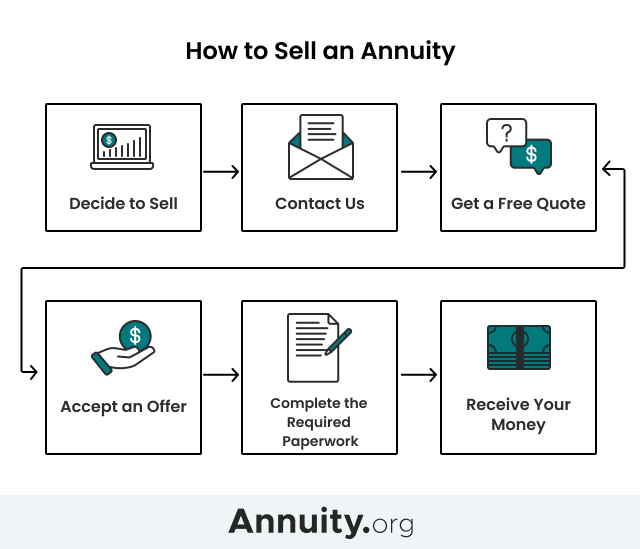

How To Sell Your Annuity Payments For Cash Step By Step Guide

Does An Annuity Plan Work For You Businesstoday

Lump Sum Or Annuity Distributions What You Need To Know Rodgers Associates

Annuity Payout Options Immediate Vs Deferred Annuities

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Strategies To Maximize Pension Vs Lump Sum Decisions

When Can You Cash Out An Annuity Getting Money From An Annuity

Lottery Payout Options Annuity Vs Lump Sum

Annuity Beneficiaries Inherited Annuities Death

Lump Sum Payment Definition Example Benefits Risks

Lottery Winner S Dilemma Lump Sum Or Annuity

Difference Between Annuity And Lump Sum Payment Infographics